A fractional share is actually a percentage of an entire share of the publicly traded enterprise. Fractional shares help buyers with smaller budgets to acquire a stake in corporations with high stock rates. By way of example, rather than paying about $a hundred and eighty to purchase a single Amazon (AMZN) share, a trader could buy a $10 fractional share – then own a proportional portion of that share.

Nathan Alderman continues to be an entire-time Motley Idiot personnel since 2005, generating faults his arch-enemies in a variety of roles like a 6-yr stint because the committed simple fact-checker for that Motley Fool's high quality publication services. As Motley Fool Income's Compliance Lead, he would make confident that each one the site's data is accurate and updated, which ensures we always steer visitors appropriate and keeps many money associates delighted.

But guiding the scenes, it's a fancy process backed by an impressive assortment of technological know-how. What was after related to shouting traders and wild hand gestures has now turn out to be much more closely related to statisticians and Personal computer programmers.

Some brokers Allow you to trade different investments, a catch-all class for specialized niche classes. Investments beneath this umbrella may well consist of new music royalties and enterprise funds open to non-accredited investors.

The very best online brokerage platform for managed accounts depends on many components, which include account administration expenses, portfolio customization and the investing techniques and attributes the platform offers. Most trading platforms within our prime rated record feature robo-investing and managed accounts.

For Chase consumers, the ease variable is an additional critical gain. The platform integrates seamlessly with current Chase accounts, making it possible for you to simply Enroll in an investment account straight from the app.

Vanguard attempts to hold its charges and cost ratios small so investors (like you) can keep more of your respective returns.

You may understand shares from brokers that supply instructional articles or blog posts and films, or it is possible to obtain monetary literacy apps. The latter are inclined to provide Chunk-sized classes on funds. It's a straightforward way to find out with no taking electronic trading platform lessons in-individual. Furthermore, It is really structured.

First, select an online broker that offers the services you'll need and open up a brokerage account. When the account is open up, You'll have to fund it by transferring dollars from a examining or savings account.

In addition to self-directed trading possibilities, Schwab also gives automated trading along with expense organizing with a specialist advisor.

Now armed with understanding about electronic trading platforms, you may have the tools to embark on your own trading journey. Pleased trading!

However, Robinhood’s instructional assets and study resources aren’t as comprehensive as other brokers, and only features real-time marketplace details and Expert investigate should you subscribe to its Gold plan for nearly $six.

Exercise initially: It is always a fantastic thought to try out any new trading procedures or learn more regarding your trading platform inside the absolutely threat-no cost ecosystem of the demo account, generally known as paper trading. Provided by most brokers, paper trading accounts let you use faux currency in the simulated trading ecosystem, ordinarily working with real-time stock charts and costs.

Mutual resources: A mutual fund is a sort of financial investment that pools revenue from a lot of investors to purchase a diverse portfolio of shares, bonds, or other securities.

Andrea Barber Then & Now!

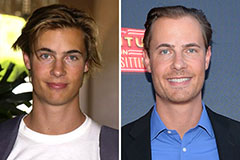

Andrea Barber Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!